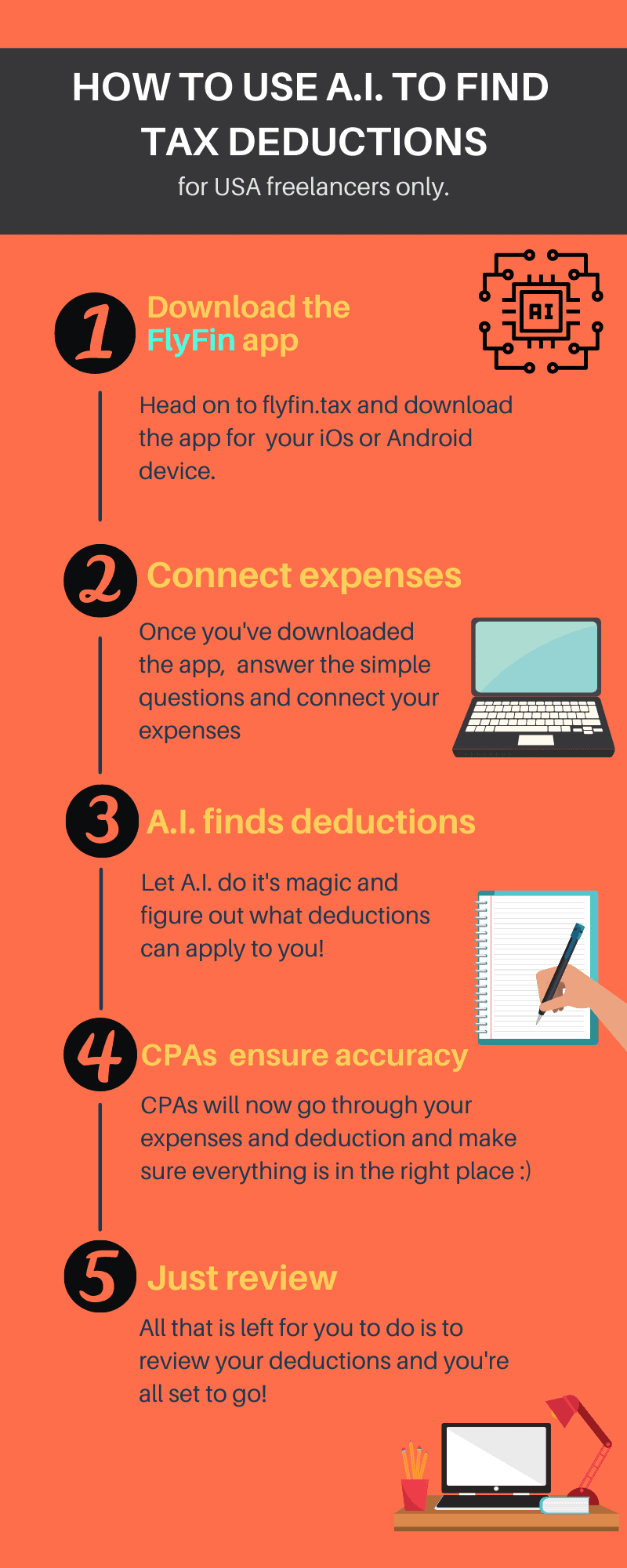

Claiming business deductions is a confusing task of an already tedious tax process, but with FlyFin, finding deductions couldn’t have been any easier. The app is powered by A.I. that works around the clock and scans through all your expenses to provide you with the most accurate deductions all the while ensuring that you don’t have to pay a penny more than what you owe.

With the FlyFin app, you can easily review the deductions, and eliminate a major chunk of your work. The A.I. asks you some basic questions to accurately calculate your tax payments in a matter of 5 minutes.

If you are unsure about some deductions, you can simply seek to advise from CPAs, they generally address your concerns within 24 hours. Now, all you are left to do is to determine whether an expense was meant for a Personal or Business Requirement, the A.I. will ask you to either Accept or Reject the expense for Business needs.

Moreover, FlyFin will remind you about all the due dates with a two-week headstart to ensure that your quarterly taxes are accurately calculated and filed on time.

Want to know more about FlyFin? Head on over to our website - https://flyfin.tax