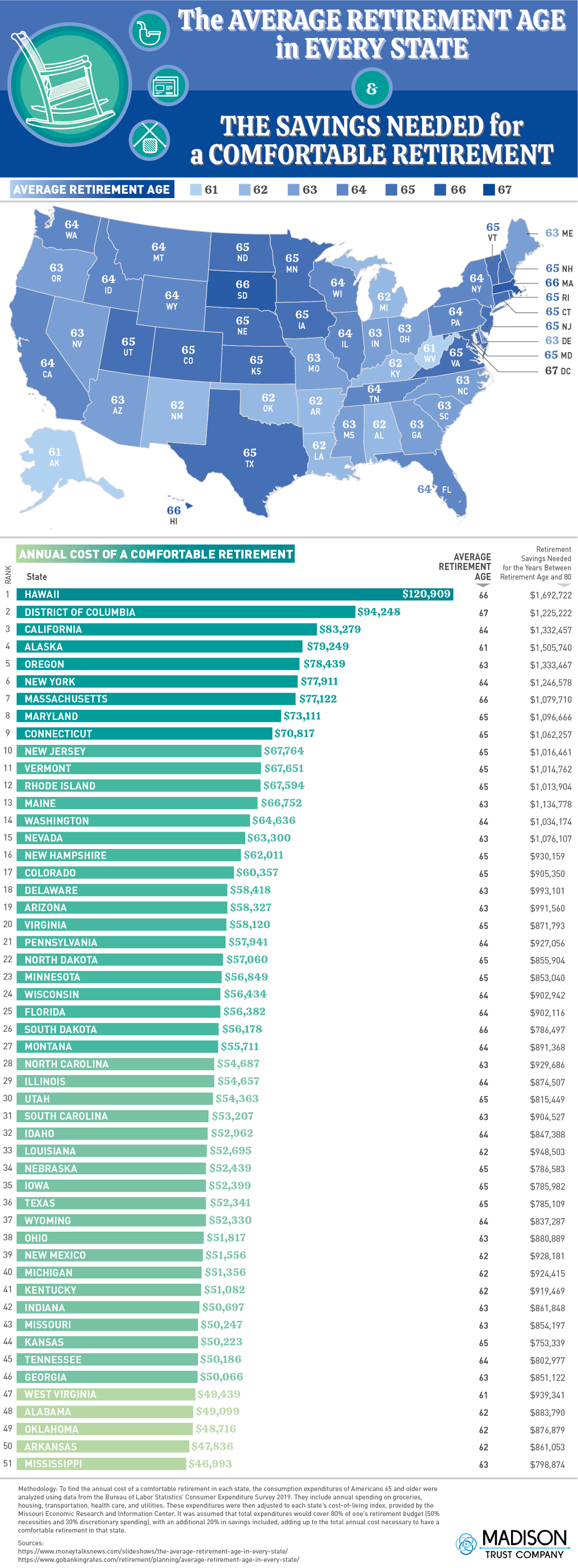

Many people know the problems our Social Security system is facing today. We still have yet to see how this may affect its ability to pay benefits in the future. Many Americans do not have sufficient savings to support themselves during retirement. According to the National Institute on Retirement Security, the average retirement savings for working-age households is just $14,500. To add insult to injury, today's soaring cost of living, including healthcare expenses, housing, energy costs, food and transportation is rising faster than wages in many parts of the country. This also makes it difficult for people to save for retirement. We can see from this map by the team at madisontrust.com exactly how much Americans need to save for a comfortable retirement in each US state. Alaska has one of the youngest average retirement ages but it will cost you just under $80,000 a year to retire comfortably there. When I think of retirement I think of beaches and sunshine like you can find in California, which is one spot ahead of Alaska for the most expensive states to retire in. To retire comfortably there at the average age of 64, you would need $83,279 today. Which spot on here would you pick?