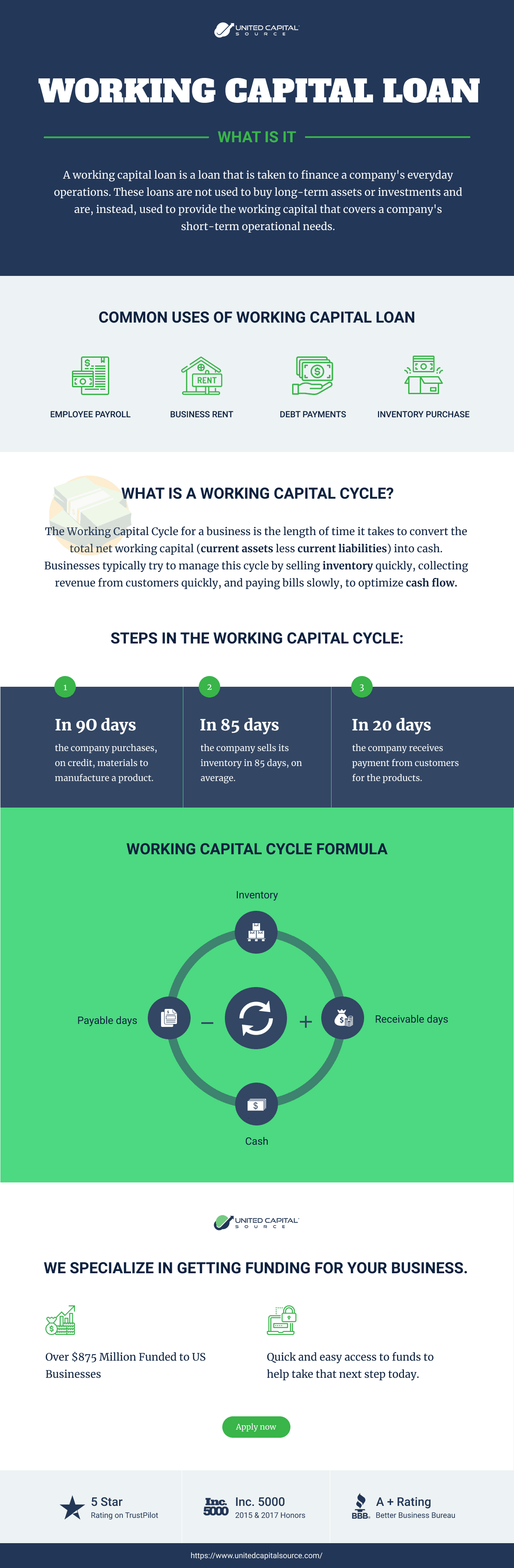

As a business owner, there are several options available when it comes to getting help in obtaining financing for business expenses. One such option is a working capital loan. This loan type is designed specifically to finance a company’s day-to-day operations (as opposed to loans designed to buy long-term assets or investments). A business will generally opt for a working capital loan in order to cover short-term operational costs such as payroll, rent, and inventory.

Calculating Working Capital

Understanding working capital is an important first step when considering a working capital loan. It is also important to keep in mind that your working capital will fluctuate constantly due to the fact that your assets and liabilities are always fluctuating. Luckily, the working capital calculation is a simple one:

Current Assets – Current Liabilities = Working Capital

Obtaining Funding

United Capital Source provides funding specifically for small businesses. In a time where traditional banks are making it harder and harder for small businesses to gain access to funding, United Capital Source is there to help small business owners get the cash they need to run their businesses.