Savings is a lifestyle choice and the early one understands the concept in life, the better it is.

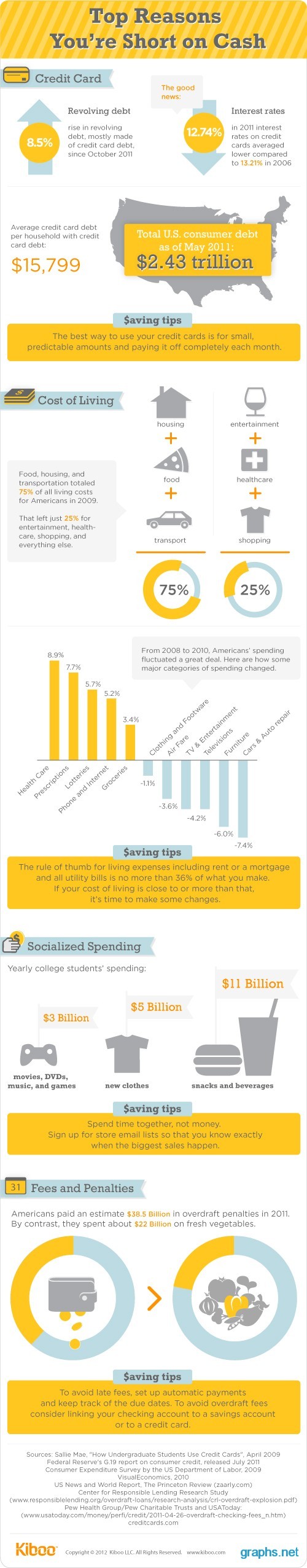

The top reason for landing in debts is attributed to the use of credit cards. The high rates of interest result in rotating debt. So the best way is to use credit cards only for small payments.

75% of the total earnings of an average American household go towards living costs expenses. This leaves only 25% for other expenses and savings. But in reality only 36% goes towards mortgage or rent and utility bills. The rest is spent on socialising, entertainment and penalties.

One can save by spending more time together than money on socializing. Make your big ticket buys during sales to save money. avoid paying your bills late. Avail ECS facility to pay your bills online, on time. The money saved on this can go into savings.