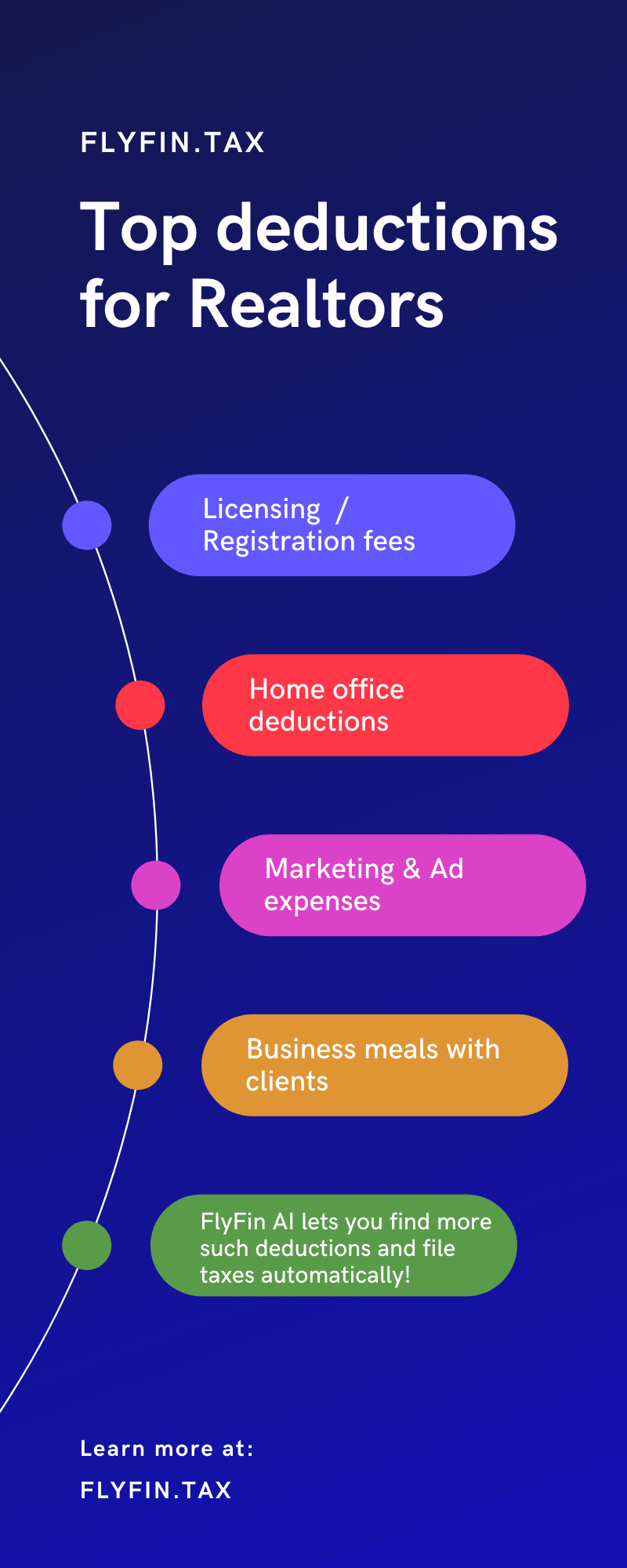

As a self-employed realtor, you must have gone through the hassle of filing your self-employment taxes. However, the good news is that there are many tax deductions available for real estate agents such as:

Licensing & registration fees: You can deduct the fees associated with your license renewal and other memberships for group or training and certification as a real state agent.

Business meals with clients: Any meals you consume while dining with clients or with other professionals for the purpose of conducting business or generating referral business are deductible.

Business Travel: If you travel for business, then you can deduct the cost of transportation, lodging, and meal expenses from your taxes. You can save quite a bit of money by claiming the travel tax deduction.

Home office deduction: If you conduct business from home, you can take advantage of the home office deduction, plus, you can also deduct some home-related expenses such as mortgage interest, insurance, utilities, repairs, depreciation for that area, etc. It is one of the most valuable tax deductions available.

Car & Mileage: If you own a car, and use it majorly for your business, you can deduct the cost of gas and other related expenses from your taxes. You can claim the deduction using either the actual expense method or the standard mileage method.

There are many other expenses you can claim as a realtor. Use FlyFin or visit https://flyfin.tax/ to find more deductions based on your profession.