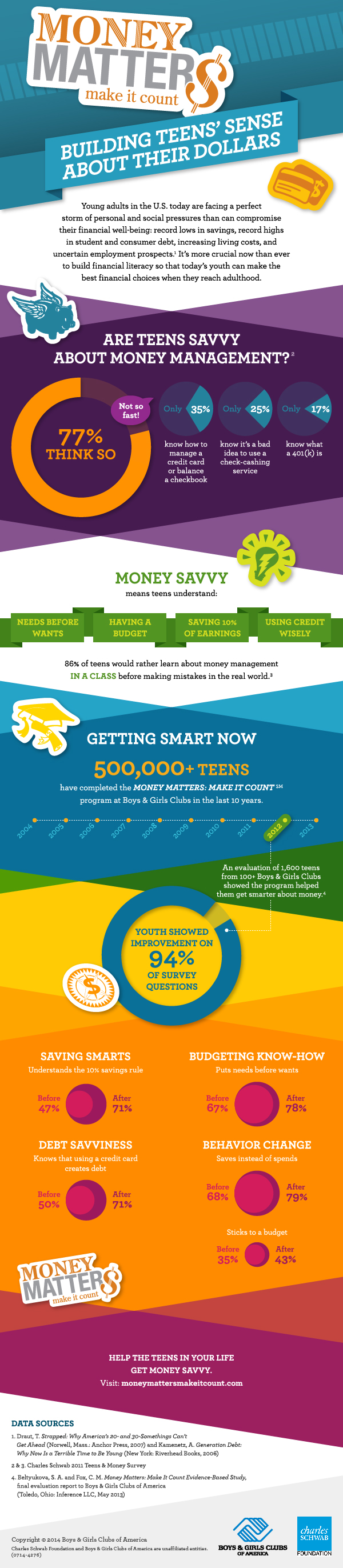

Money matters advance monetary duty and autonomy for students age 13-18 by building cash administration abilities. Youthful grown-ups in the U.S. today are confronting an ideal tempest of individual and social pressures that can bargain their monetary prosperity: record lows in investment funds, record highs in student and buyer obligation, expanding living expenses and unverifiable business prospects.

A financial literacy program made by the Charles Schwab Establishment and the Young men and Young ladies Clubs of America has achieved a half million youngsters.

The monetary training educational programs. Money Matters: Make It Count, created in 2002, ingrains the nuts and bolts of planning, obtaining, contributing, business enterprise, and putting something aside for instruction after secondary school in a way that is significant to teenagers.

They will be grown-ups managing employments, bills, car installments, contracts, investment accounts, financing costs, swelling, reimbursement of understudy advances, and day by day obtaining choices. Achievement does not rely upon riches, but rather it depends on the aptitudes of shrewd cash administration. Materials are accessible on the web.

The Youngster Individual Back Guide is a fun, inventive and valuable instrument for teenagers. It incorporates reasonable tips and exercises to enable teenagers to take in the vital abilities to adjust a checkbook, making a financial plan and contributing to school and retirement.

The guide additionally furnishes youngsters with essential enterprise data for those intrigued by beginning organizations.