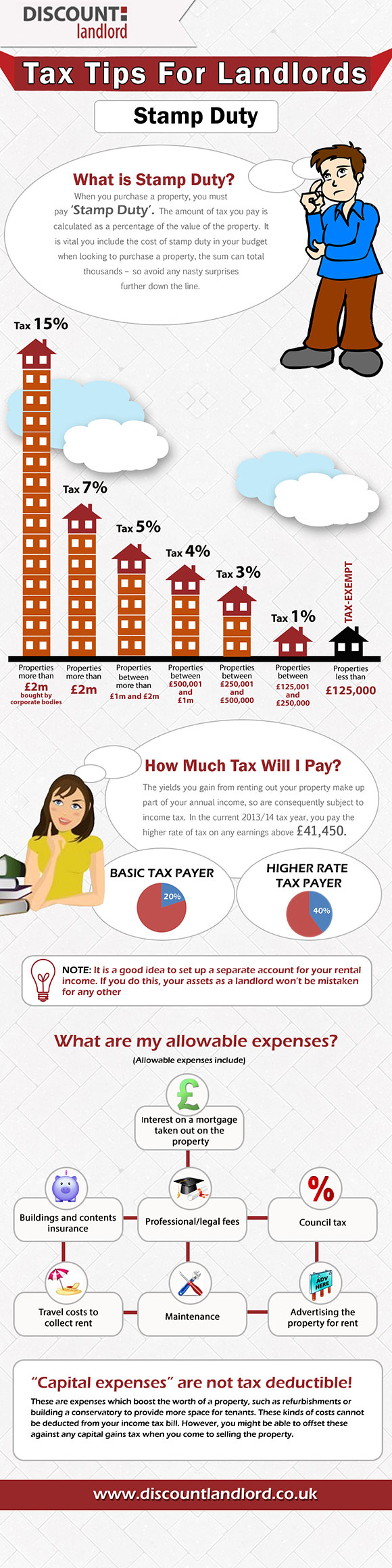

Stamp duty is the amount collected by the government when you purchase a property you must pay stamp duty.

The amount of tax you pay is calculated as a percentage of value of property it is vital that you include the cost of stamp duty in your budget when looking forward to buy a property; the sum can total thousands so avoid any nasty surprises further down the line.

The yields you gain on renting on your property make up part of your annual income, so are consequently subject to income tax. In the current 2013-14 year pay the highest rate of tax on your earnings above 41,450 Euros.