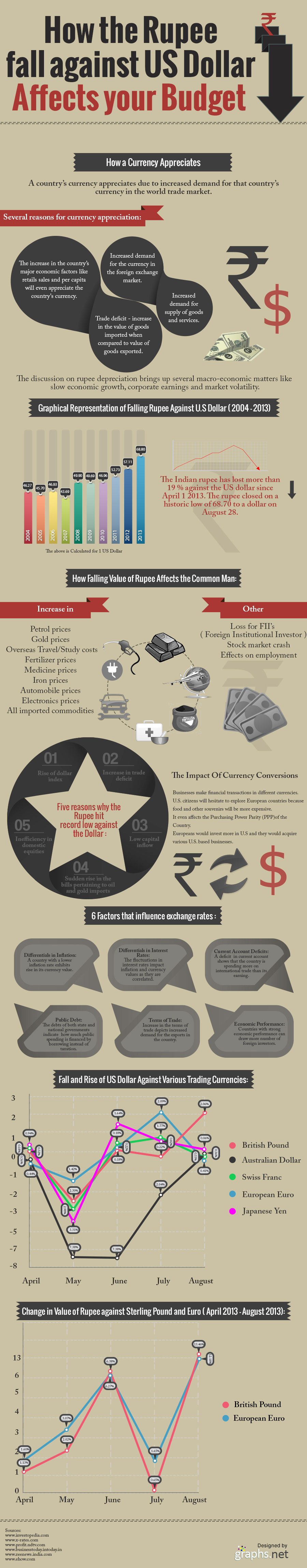

In the last 10 years of international trade market, rupee has never hit such low against the US dollar. The Indian government has taken several measures to restrict the free fall of Indian rupee, but couldn’t stop the rupee value to drop down to 68.75 against the US dollar.

As the rupee continues its plunge against Dollar, there will be great affect on the common man as prices of general commodities get increased and there will be huge hike in the costs of electronics goods and automobiles as companies rise their product prices to offset their business margins.

A survey revealed that increase of dollar index, enhancement of trade deficit, low capital inflow and weak economy of the country are few major reasons that resulted in drop down of rupee value in contrast to US dollar.

The currency conversions will have a great impact on businesses that make online financial transactions. Besides, even the purchasing power parity of the country get affected due to sudden plunge of that country’s currency value.

Along with Indian Rupee, several other popular trading currencies such as Japanese Yen, South African Rand, Swiss Franc and Australian Dollar have seen a great decrease in their value against the US dollar.