Petroleum, a critical concern for many nations, is vital to many industries and is of importance to the maintenance of industrial civilization in its current configuration.

Oil accounts for a large percentage of the world’s energy consumption, ranging from as low of 32% for Europe and Asia, up to a high of 53% for the Middle East.

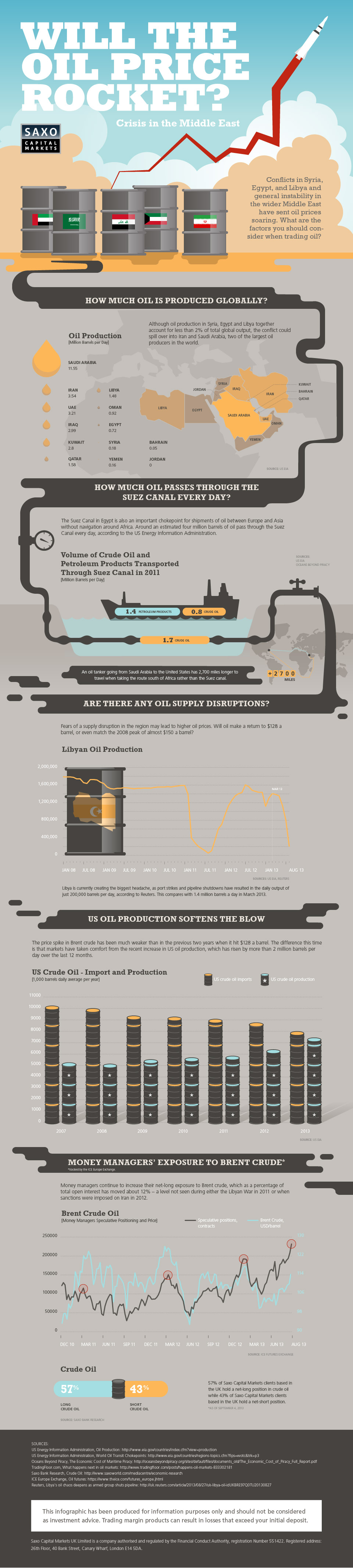

Present crisis in Syria indicates a future hike in the petrol price of petroleum. This has added tension both in Libya as well as in Egypt.

US production lines help to offset oil price spikes, with price increases in Brent crude oil having been mitigated by US crude oil production. Market fears have been assuaged by the rise in production, which has climbed by more than 2 million barrels per day over the last year. Yet money managers continue to raise their bets that the price of crude oil will grow. In addition, President Obama’s refusal to agree to the Keystone XL Pipeline to expand US oil drilling programs increases the dependency on Middle East oil, and heightens the importance of avoiding a disruption of supply routes.

It is conceivable that the conflicts in Syria, Egypt and Libya will have a spill-over effect across the Middle East. The impact in Saudi Arabia and Iran, the region’s two biggest exporters of oil and two of the largest oil producers globally, could trigger a precipitous rise in oil trading prices.