Life insurance is an agreement between a protection arrangement holder and a safety net provider or assurer, where the backup plan guarantees to pay an assigned recipient a total of cash (the advantage) in return for a premium, upon the demise of a safeguarded individual (regularly the strategy holder).

Contingent upon the agreement, different occasions, for example, terminal ailment or basic sickness can likewise trigger installment. The policy holder ordinarily pays a premium, either consistently or as one single amount. Different costs, for example, memorial service costs, can likewise be incorporated into the advantages.

Life policies are legitimate contracts and the terms of the agreement portray the restrictions of the safeguarded occasions. Particular avoidances are regularly built into the agreement to restrain the risk of the backup plan; normal cases are claims identifying with suicide, fraud, war and riot.

LIFE-BASED CONTRACTS TEND TO FALL INTO TWO NOTEWORTHY CLASSES:

PROTECTION POLICIES : Intended to give an advantage, commonly a singular amount installment, in case of a predefined event. A typical frame more typical in years past—of a security strategy configuration is term protection.

INVESTMENT POLICIES : The fundamental target of these policies is to encourage the development of capital by consistent or single premiums. Common forms (in the U.S.) are entire life, all inclusive life, and variable life arrangements.

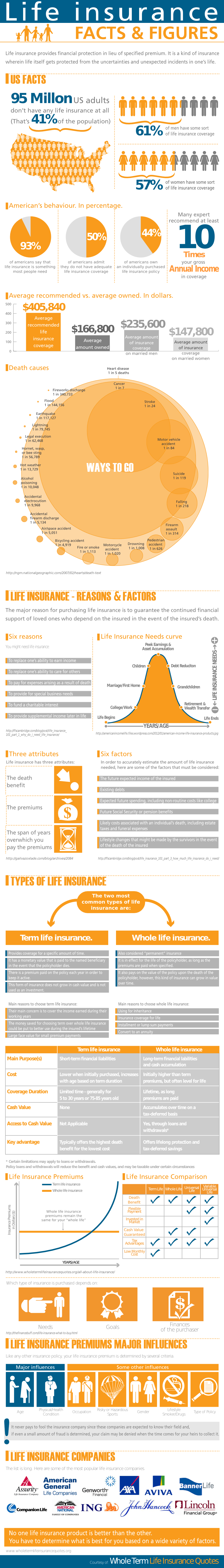

Here is a fascinating information realistic that will demonstrate some extraordinary actualities from death causes to sorts of life coverage.