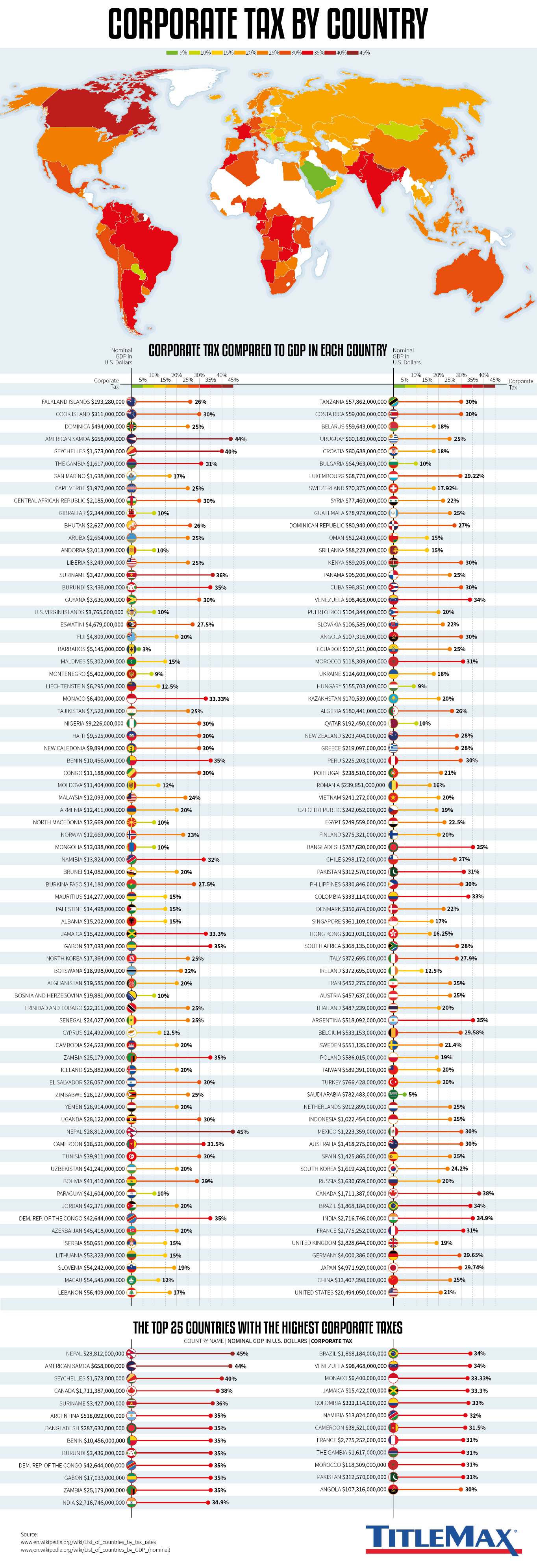

Corporate tax avoidance is a hot-button issue right now. The United States has the largest GDP in the world, but at 21%, our corporate tax rate is below average. To make matters worse, many U.S.-based companies are paying an even lower rate than that thanks to tax rebates. It’s clear that choosing the right place to base your corporation – as well as making the most of tax breaks – has a lot to do with how much you’ll be paying in taxes.

This interesting infographic maps out the corporate tax rates in each country, and the results are unexpected. Nepal tops the list with a corporate tax rate of 45%, and American Samoa isn’t far behind at 44%. At the other end of the spectrum, there are several countries (like Bermuda and the Cayman Islands) that are completely tax-free for corporations.

Of all the countries on the graphic, which country’s corporate tax rate surprised you the most?